Having used Rob Hyndman’s forecasting package in R, I decided to give Facebook’s Prophet package a spin and do a comparison of the results.

##Forecasts using Prophet

The Time-series data sets: - Daily data set

## y ds

## 1 8 2016-05-10

## 2 10 2016-05-11

## 3 3 2016-05-11

## 4 7 2016-05-12

## 5 3 2016-05-12

## 6 3 2016-05-12Prophet provides the ability to forecast projected growth based on market intel, by specifying the carrying capacity ‘cap’; the forecast should reach the maximum/saturation at the set ‘cap’. For this data set, I’ve set the cap at 7 units/day, but the forecaster can choose to set it at an increasing/decreasing sequence.

daily_Data_wgrowth <- daily_data %>%

mutate(cap = 7)

head(daily_Data_wgrowth)## y ds cap

## 1 8 2016-05-10 7

## 2 10 2016-05-11 7

## 3 3 2016-05-11 7

## 4 7 2016-05-12 7

## 5 3 2016-05-12 7

## 6 3 2016-05-12 7Visualize the daily timeseries

ggplotly(ggplot(daily_data, aes(x = ds, y = y)) + geom_line(color = "firebrick") + ggtitle("Daily Timeseries")) Functions calling function prophet that fits and returns the model, then predicts on the model object. More info available from Prophet’s page

#Function to apply prophet model to timeseries

prophet_apply <- function(timeseries, growthtype = NULL) {

if(is.null(growthtype))

prophet(timeseries)

else

prophet(timeseries, growth = growthtype)

}

#Create future data_frame and predict on the model object

prophet_fcst_apply <-

function(m,

length_time,

cap_size = NULL) {

if (is.null(cap_size))

{ future_df <- make_future_dataframe(m, periods = length_time)

}

else

{ future_df <- make_future_dataframe(m, periods = length_time)

future_df['cap'] = cap_size

}

fcst_df <- predict(m, future_df)

}Model and forecast with prophet:

model_daily <- prophet_apply(daily_data)## Initial log joint probability = -46.2524

## Optimization terminated normally:

## Convergence detected: relative gradient magnitude is below tolerancemodel_daily_wgrowth <- prophet_apply(daily_Data_wgrowth, 'logistic')## Initial log joint probability = -13.2458

## Optimization terminated normally:

## Convergence detected: relative gradient magnitude is below toleranceFcst_daily <- prophet_fcst_apply(model_daily, 730)

Fcst_daily_wgrowth <- prophet_fcst_apply(model_daily_wgrowth, 730, 7)View forecasted units with their upper/lower confidence interval

#Select forecast with lower/upper confidence intervals from the predicted object

#Specify time frame for selection

view_select_Fcst <- function(fcst_df, date_begin, date_end) {

selected_Fcst <- fcst_df %>%

filter(ds >date_begin & ds< date_end) %>%

select(ds, yhat, yhat_lower, yhat_upper)

}

tail(view_select_Fcst(Fcst_daily, "2017-04-01", "2018-04-01"))## ds yhat yhat_lower yhat_upper

## 360 2018-03-27 5.568770 1.2557720 9.688349

## 361 2018-03-28 5.449173 1.1129391 9.736892

## 362 2018-03-29 5.286332 0.9718378 9.680816

## 363 2018-03-30 5.475638 1.5285363 9.935465

## 364 2018-03-31 4.480532 0.3557986 8.664323

## 365 2018-04-01 5.195860 1.3188466 9.543473Visualize the forecast by calling the generic plot function. I’m wrapping ggplotly(via Plotly package) around the plot function for interactive web-based version.

Plots for forecasted daily data:

#Plot function for daily fcst

plot_daily <- function(m, fcst, fnc) {

fnc(m, fcst)

}

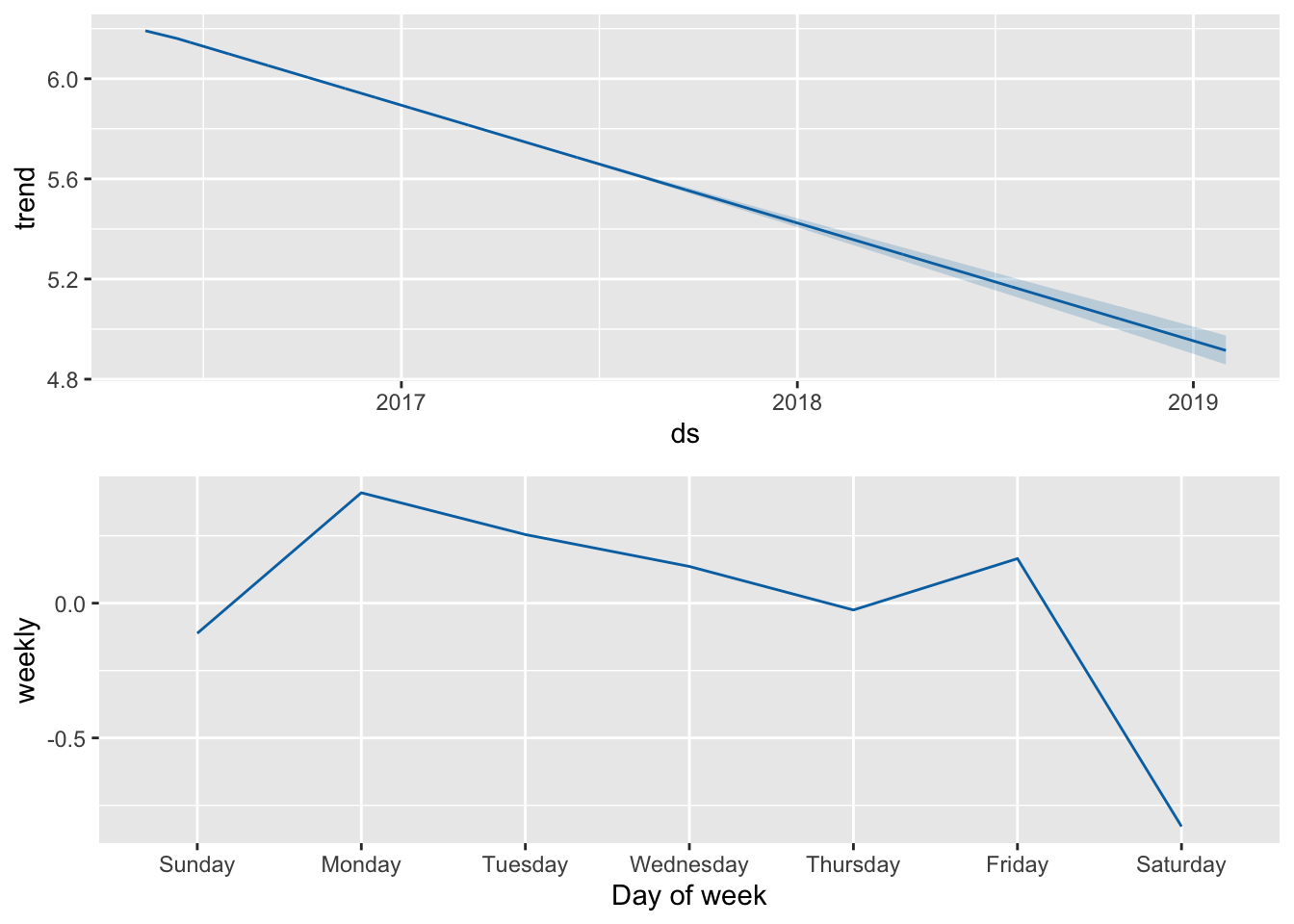

ggplotly(plot_daily(model_daily, Fcst_daily, plot))plot_daily(model_daily, Fcst_daily, prophet_plot_components)

Sum forecast unit totals and forecast order dollars based on user specified price (in this case. price is set at $25).

#summarise yearly forecast units and order dollars

summary_fcst_units_price <- function(df, price, fcst_num) {

df %>%

dplyr::summarise(Fcst_qty = sum(df[[fcst_num]]), Fcst_Dlrs = Fcst_qty*price)

}Daily data set:

#Call summary_fcst_units_price function on the predicted daily numbers

sum_daily <- summary_fcst_units_price(view_select_Fcst(Fcst_daily, "2017-04-01", "2018-04-01"), 25, "yhat")

sum_daily## Fcst_qty Fcst_Dlrs

## 1 2022.837 50570.94Plots for daily_data with growth

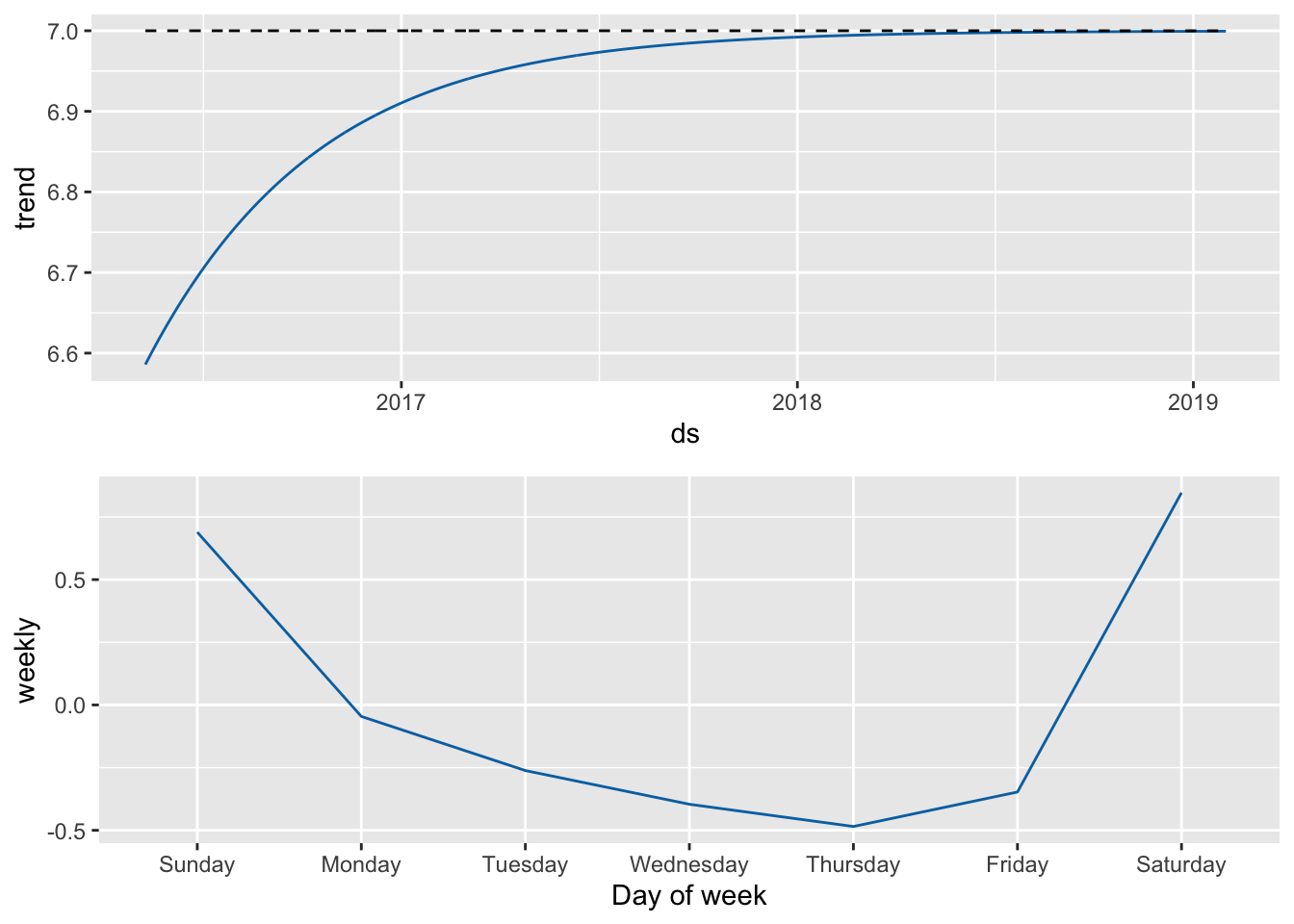

ggplotly(plot_daily(model_daily_wgrowth, Fcst_daily_wgrowth, plot))plot_daily(model_daily_wgrowth, Fcst_daily_wgrowth, prophet_plot_components)

Daily_data with growth set:

tail(view_select_Fcst(Fcst_daily_wgrowth, "2017-04-01", "2018-04-01"))## ds yhat yhat_lower yhat_upper

## 360 2018-03-27 6.733838 2.182734 11.12016

## 361 2018-03-28 6.599399 2.431310 11.28659

## 362 2018-03-29 6.510695 2.053849 11.02729

## 363 2018-03-30 6.648348 1.935214 11.06018

## 364 2018-03-31 7.842190 3.437448 11.95472

## 365 2018-04-01 7.684945 3.518858 11.78566sum_daily_wgrowth <- summary_fcst_units_price(view_select_Fcst(Fcst_daily_wgrowth, "2017-04-01", "2018-04-01"),25, "yhat")

sum_daily_wgrowth## Fcst_qty Fcst_Dlrs

## 1 2548.958 63723.95Forecasts using Forecast Package by Hyndman

Using Auto ETS:

#Auto ETS forecast

daily_ts <- ts(daily_data[,1], start(2016,1,1), frequency = 7)

daily_auto_fcst <- forecast(daily_ts, h = 365)

#autoplot(daily_auto_fcst)

ggplotly(autoplot(daily_auto_fcst))Sum total units and total order dollars based on price at $25

sum_hyndman_ets <- summary_fcst_units_price(data.frame(daily_auto_fcst), 25, "Point.Forecast")Using Auto Arima:

#Auto Arima Forecast

fit_ar_daily<- auto.arima(daily_ts)

daily_auto_ar_fcst <- forecast(fit_ar_daily, h = 365)

#autoplot(daily_auto_fcst)

ggplotly(autoplot(daily_auto_fcst))sum_hyndman_ar <- summary_fcst_units_price(data.frame(daily_auto_ar_fcst), 25, "Point.Forecast")Let’s now compare the forecast results from Prophet and Forecast package by Hyndman

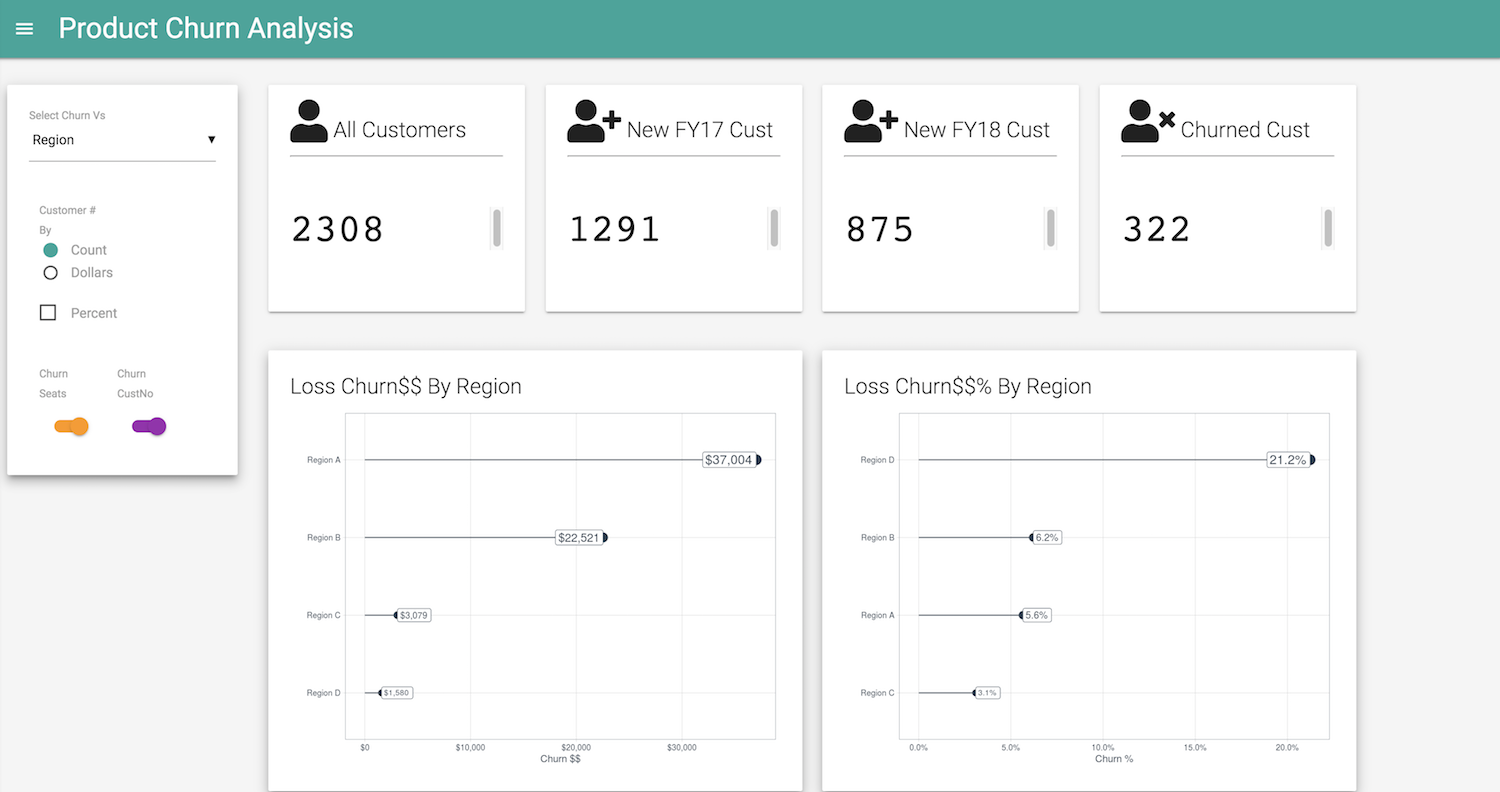

All_TS_fcst <- full_join(full_join(sum_daily, sum_daily_wgrowth), full_join(sum_hyndman_ets, sum_hyndman_ar))

rownames(All_TS_fcst) <- c("Fcst_daily_prophet", "Fcst_daily_wgrowth_prophet", "Fcst_daily_forecast_ETS", "Fcst_daily_forecast_ARIMA")

knitr::kable(All_TS_fcst, caption = "Forecasts from Prophet & Forecast Package")| Fcst_qty | Fcst_Dlrs | |

|---|---|---|

| Fcst_daily_prophet | 2022.837 | 50570.94 |

| Fcst_daily_wgrowth_prophet | 2548.958 | 63723.95 |

| Fcst_daily_forecast_ETS | 2251.012 | 56275.30 |

| Fcst_daily_forecast_ARIMA | 2250.967 | 56274.18 |

Share this post

Twitter

Google+

Facebook

Reddit

LinkedIn

StumbleUpon

Pinterest

Email